Customer Lifetime Value (CLV) is a powerful metric that helps product managers focus on long-term profitability instead of short-term wins. It calculates the total revenue a customer is expected to generate over their relationship with your business. Here's when and how to use CLV effectively:

- Best Scenarios for CLV:

- Resource Constraints: Focus on high-value customer segments when budgets or time are tight.

- Loyalty-Driven Markets: Prioritize features that drive repeat purchases in industries like SaaS, e-commerce, or travel.

- Scaling Decisions: Use CLV to identify profitable markets or customer segments when expanding.

- When CLV Falls Short:

- Early-Stage Products: Insufficient data makes CLV unreliable; focus on metrics like activation or retention instead.

- Unpredictable Markets: Rapidly changing industries require short-term metrics like 30–90 day retention.

- Low-Margin Products: For one-time purchases or low-profit items, prioritize unit economics over CLV.

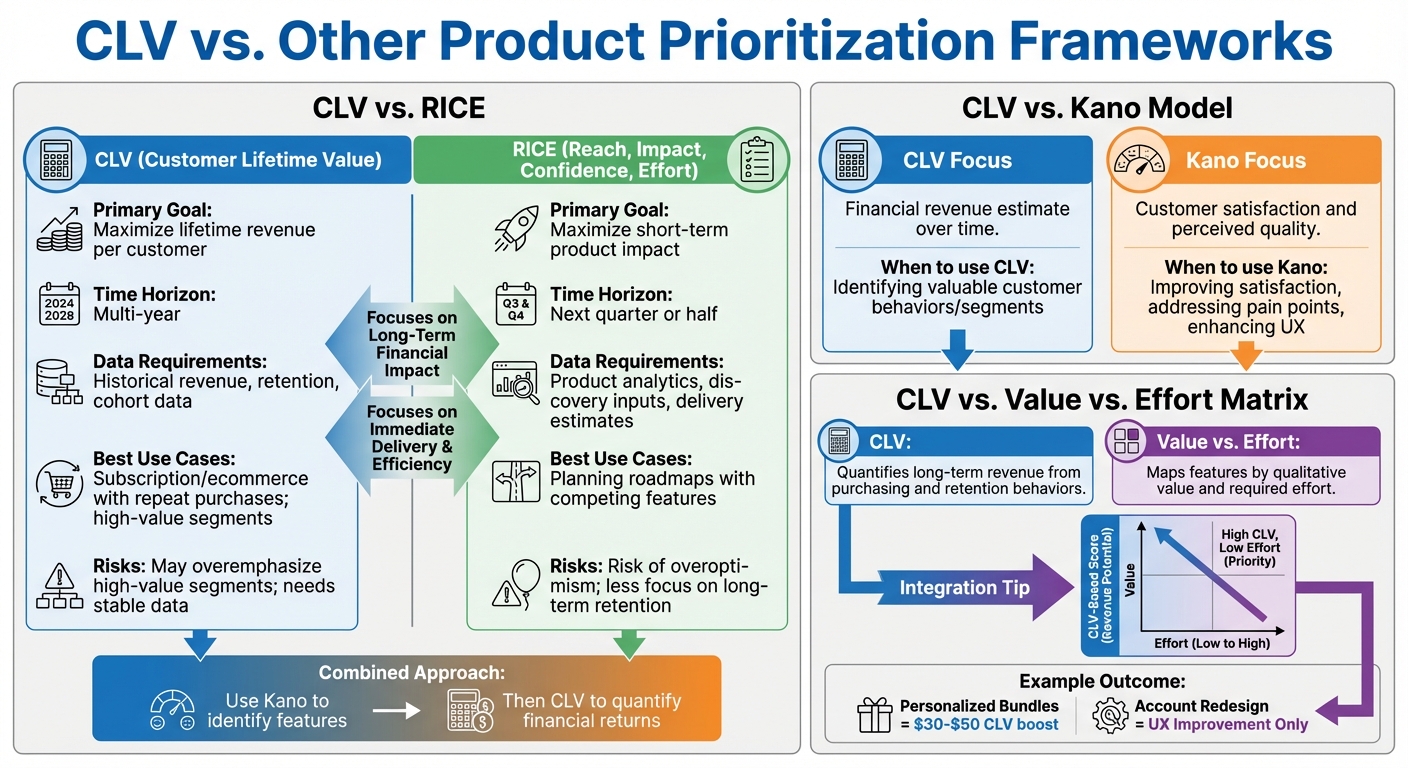

- CLV vs. Other Frameworks:

- RICE: Better for short-term impact; CLV focuses on long-term revenue.

- Kano Model: Focuses on satisfaction, while CLV targets financial returns.

- Value vs. Effort Matrix: Combine CLV with effort metrics to prioritize features with the best revenue potential.

CLV emphasizes retaining high-value customers and aligning product decisions with long-term growth. To make the most of CLV, ensure accurate data, track metrics like retention and repeat purchases, and integrate it with other prioritization frameworks for a balanced approach.

Do CLV Insights Help Prioritize Customer Service Resources?

When to Use CLV for Product Prioritization

Customer Lifetime Value (CLV) proves especially useful when long-term customer relationships are key to driving profitability. By understanding when to lean on CLV, product managers can make smarter decisions about allocating limited resources, deciding which features to develop, and identifying the most promising markets to pursue. Below are scenarios where CLV plays a critical role in feature prioritization.

Resource-Constrained Environments

When resources like budget, engineering capacity, or time are tight, CLV helps focus efforts where they’ll have the greatest impact. Instead of trying to cater to all users equally, you can zero in on high-value customer segments and prioritize features that keep them engaged and spending. For instance, if customers acquired through a specific marketing channel show higher CLV, it makes sense to prioritize features that enhance their experience or reduce friction in their workflows. This approach ensures every development dollar contributes to protecting or increasing long-term revenue.

CLV is also invaluable for prioritizing support and reliability improvements. Bugs affecting high-CLV users should take precedence over less impactful issues, and performance upgrades can be justified when they protect a significant share of revenue. This way, you’re not just fixing problems - you’re safeguarding relationships with your most valuable customers.

Loyalty and Repeat Purchase-Driven Markets

In industries where repeat purchases are a core driver of success - think subscription services, SaaS platforms, e-commerce, travel, or marketplaces - CLV becomes a go-to metric for prioritization. These businesses rely on frequent purchases, loyalty program participation, and bigger basket sizes, making CLV a reliable gauge of long-term success.

In such markets, product decisions should focus on features that encourage repeat behavior. For example, investments in loyalty programs, personalized recommendations to increase order value, or improved post-purchase experiences (like smoother returns or reordering processes) can strengthen relationships with high-CLV customers and keep them coming back.

Mapping customer journeys can reveal which features drive higher lifetime value - such as saved payment methods, wishlists, subscriptions, or personalized email campaigns. By comparing high-CLV and low-CLV customer cohorts, teams can estimate the potential CLV boost from targeted improvements. Running A/B tests that measure not just short-term conversions but also long-term metrics like repeat purchase rates or 90-day revenue per user provides actionable insights for prioritization.

Scaling or Expansion Decisions

CLV also plays a major role when scaling or entering new markets. Whether you’re targeting a new customer segment, industry vertical, or geographic region, CLV offers a clear picture of the long-term economic potential of each option. This helps teams focus on sustainable, profitable growth instead of chasing vanity metrics like high signup numbers.

For example, if mid-market B2B healthcare clients show a CLV of $50,000 over five years compared to $8,000 for small businesses in another sector, prioritizing features and integrations that deepen engagement with the higher-value segment becomes a no-brainer - even if the acquisition volume is lower. Similarly, early data from trial users or beta testers can help forecast CLV by region, guiding expansion into areas with better retention and upsell potential.

In new markets, short-term data points like activation rates, 30–90-day retention, and upgrade patterns can serve as proxies for CLV. Running small, targeted pilots with clear tracking of usage, revenue, and churn allows you to estimate cohort CLV and refine assumptions as more data comes in. Treating the first 6–12 months as a learning phase ensures your CLV model is accurate before committing to large-scale investments.

When Not to Use CLV as the Primary Metric

CLV can be a useful tool in many situations, but it’s not always the best fit. Depending on your product, market, or business model, relying too heavily on CLV can lead to poor decisions. It works best when you have stable customer behavior, solid historical data, and opportunities for repeat purchases. Below are some scenarios where the assumptions behind CLV fall short, along with suggestions for alternative metrics.

Early-Stage Products or Startups

For startups or new products, CLV calculations are often unreliable. Why? The formula depends on inputs like average purchase frequency, customer lifespan, and churn rate, which require an established user base. Without sufficient historical data, any estimates are likely to be inaccurate.

Instead of focusing on speculative lifetime value, prioritize learning-focused metrics such as activation rates, user feedback, and early retention trends. Tools like the Systemico model or Kano analysis are particularly helpful at this stage, as they focus on understanding customer needs and satisfaction without requiring long-term financial predictions.

Volatile or Unpredictable Markets

In markets where conditions change rapidly - like fashion or consumer tech - long-term forecasting can be risky. CLV assumes customer behavior remains relatively stable, but external factors such as economic shifts, seasonal trends, or new competitors can quickly render projections useless.

Here, short-term metrics are more practical. Metrics like cohort retention over 30–90 days provide actionable insights without depending on long-term assumptions. Using CLV as your guiding metric in these situations could lead to resource allocation based on outdated or overly optimistic forecasts.

Low-Margin or One-Time Purchase Products

For products with low profit margins or limited repeat purchase opportunities, such as basic electronics, commodities, or one-off services, CLV is naturally low. A one-time buyer of a smartphone or an appliance won’t generate enough lifetime value to justify CLV-driven strategies.

In these cases, focus on metrics that align with your business model. Unit economics, contribution margin per transaction, and operational efficiency are more relevant. Metrics like conversion rate, average order value, and cost to serve can help you prioritize effectively. Frameworks like the Value vs. Effort Matrix or Kano Model can also guide decisions to improve single-transaction experiences or reduce costs without relying on lifetime projections that don’t match your product’s reality.

How CLV Compares to Other Prioritization Frameworks

Looking at CLV (Customer Lifetime Value) alongside other frameworks like RICE, Kano, and the Value vs. Effort Matrix offers a clearer picture of how to prioritize products with a focus on customer-centric strategies. Each framework has its strengths, and understanding their differences can help you pick the right approach - or even combine them - for smarter decision-making. Here's how they stack up.

CLV vs. RICE (Reach, Impact, Confidence, Effort)

The RICE framework scores features by factoring in Reach (how many users are affected), Impact (the effect on each user), Confidence (how sure you are of your estimates), and Effort (resources required). This makes it great for short-term decisions, like picking features for an upcoming product roadmap. CLV, on the other hand, focuses on long-term revenue by analyzing customer retention and repeat purchases.

The main distinction is timeframe and focus. RICE is all about maximizing near-term impact across a wide user base, while CLV hones in on lifetime revenue from specific customer groups. For example, if a loyalty program for a U.S. ecommerce site shows that repeat customers spend an average of $250, with potential for a 15–20% revenue boost, CLV can bring those long-term benefits into the conversation. You could even incorporate CLV insights into RICE scoring to balance immediate feasibility with future gains.

CLV works best for businesses where retention and monetization are key, like SaaS or ecommerce companies where a small group of high-value customers drives most of the revenue. RICE, however, shines when you need to prioritize quick wins or validate features for a minimum viable product.

Dimension | CLV | RICE |

|---|---|---|

Primary Goal | Maximize lifetime revenue per customer | Maximize short-term product impact |

Time Horizon | Multi-year | Next quarter or half |

Data Requirements | Historical revenue, retention, cohort data | Product analytics, discovery inputs, delivery estimates |

Best Use Cases | Subscription/ecommerce with repeat purchases; high-value segments | Planning roadmaps with competing features |

Risks | May overemphasize high-value segments; needs stable data | Risk of overoptimism; less focus on long-term retention |

CLV vs. Kano Model

The Kano Model sorts features into three categories: must-haves (basic needs), performance features (directly tied to user satisfaction), and delighters (unexpected features that wow users). Its focus is on improving satisfaction and perceived quality, not necessarily revenue. CLV, in contrast, provides a financial estimate of the revenue a customer is likely to generate over time.

Kano is your go-to when the goal is to improve customer satisfaction or metrics like NPS. It’s particularly effective for addressing pain points or enhancing user experience. CLV, however, is better suited for identifying which customer behaviors or segments are most valuable to retain and grow. For instance, if one segment has a CLV three to four times higher than others, CLV analysis can guide decisions that maximize returns from that group.

These frameworks can also complement each other. Start with Kano to identify essential and delight features, then apply CLV to quantify which updates will deliver the greatest financial returns. For example, if a new feature classified as a "delighter" boosts CLV by $40 for high-value customers, you’ve successfully tied customer satisfaction to revenue growth.

CLV vs. Value vs. Effort Matrix

Unlike Kano, which focuses on satisfaction, the Value vs. Effort Matrix simplifies operational decisions. This tool maps features based on their expected value and the effort required to deliver them. It’s perfect for quick prioritization, like deciding which small UX tweaks or features to tackle in a sprint. Here, "value" is often measured qualitatively, factoring in things like user satisfaction or strategic fit, rather than strict revenue.

CLV, however, quantifies long-term revenue by analyzing purchasing and retention behaviors, making it essential for strategies aimed at deepening customer relationships. While detailed CLV modeling might not suit fast decision-making, its insights can still enrich the Value vs. Effort Matrix. For instance, you could replace the "value" axis with a CLV-based score to highlight features with the greatest revenue potential.

Imagine a U.S. direct-to-consumer brand comparing two options: "Add personalized bundles at checkout" versus "Redesign account settings." Personalized bundles might increase average order value by 8% for repeat buyers, translating to a $30–$50 CLV boost. Meanwhile, redesigning account settings might mainly improve user experience. By plotting these options with CLV uplift as the value metric and engineering days as the effort metric, it becomes clear which investment offers the better payoff.

Key Takeaways on Using CLV for Product Prioritization

CLV's Role in Product Management

Customer Lifetime Value (CLV) shifts the focus from short-term wins to long-term growth. Instead of chasing one-time conversions, it encourages prioritizing features that strengthen relationships with your most valuable customers. Since a small portion of customers often accounts for the majority of revenue, segment-level CLV becomes a crucial tool for making smarter decisions about your product roadmap. Take Starbucks, for instance - their loyalty program emphasizes rewards and personalized experiences, which increase CLV through repeat visits and drive consistent growth.

Pairing CLV insights with frameworks like RICE or Kano allows you to balance immediate impact with long-term value. For example, you can adjust the Impact score by factoring in projected lifetime revenue gains or identify features that create the biggest boost for customer satisfaction. This approach helps you weigh reach, effort, and customer satisfaction effectively, creating a more strategic and balanced decision-making process.

Tips for Effective CLV Use

To make the most of CLV, ensure every product decision contributes to building lasting customer value. Start by tracking CLV at the segment level rather than as a single overall figure. Pinpoint your highest-value customer groups - such as enterprise clients, frequent buyers, or long-term subscribers - and focus on features that solve their most critical challenges.

Accurate data is key. Use reliable inputs like average purchase value, purchase frequency, and customer lifespan. Align these metrics across teams like finance, marketing, and analytics to ensure consistency. Regularly update your data to reflect changes in the market, keeping your decisions relevant and informed.

Integrate tools to measure the impact of CLV-focused strategies. Define success metrics such as retention rates at 90, 180, or 365 days, expansion revenue, and repeat purchase frequency. When testing, go beyond click-through rates - look at leading indicators like deeper engagement, feature adoption tied to retention, or subscription renewals. Research backs this up: high experience scores can boost spending by 6%, while low scores can reduce it by 4%. This demonstrates how thoughtful product decisions can significantly enhance lifetime value.

FAQs

How can you combine CLV with other prioritization frameworks for better product decisions?

To make the most of Customer Lifetime Value (CLV) in your decision-making, start by using CLV data to pinpoint the customer segments that bring the highest long-term value. Once you've identified these key groups, you can pair this information with prioritization frameworks like RICE (Reach, Impact, Confidence, Effort) or MoSCoW (Must-haves, Should-haves, Could-haves, Won’t-haves). This combination helps ensure your product decisions not only align with overall business goals but also prioritize features that boost profitability and meet customer expectations.

By integrating CLV with these frameworks, you can focus on features that offer the best return on investment while maintaining a balance between immediate needs and opportunities for sustained growth.

What are the main challenges of using CLV for prioritizing early-stage products?

When it comes to using Customer Lifetime Value (CLV) to guide decisions for early-stage products, there are a few hurdles to consider. One major issue is the lack of reliable user data. Early-stage products typically don’t have enough customer interactions to create accurate projections, making it tough to lean on CLV as a dependable metric.

Another complication is the difficulty in predicting future customer behavior. Without established patterns, it’s nearly impossible to make confident assumptions about how customers will engage with the product over time.

On top of that, CLV might not even be clearly measurable in the early phases, which could lead to poor decision-making. At this stage, it’s often more effective to focus on building a deeper understanding of customer needs and gathering meaningful data before relying too heavily on CLV metrics.

Why is CLV essential for success in loyalty-focused markets?

Customer Lifetime Value (CLV) plays a crucial role in markets where loyalty drives success. It emphasizes the financial benefits of retaining customers over the long term, helping businesses zero in on strategies that encourage repeat purchases, deepen relationships, and enhance customer satisfaction.

By focusing on CLV, businesses can better allocate resources to their most valuable customers, paving the way for sustainable growth and long-term profitability.

If you’re finding this blog valuable, consider sharing it with friends, or subscribing if you aren’t already. Also, consider coming to one of our Meetups and following us on LinkedIn ✨ And check out our official website.

Connect with the founder on LinkedIn. 🚀